Delivering on our Purpose

Our mission: creating a better society

At Unity, we measure success in two ways, financial performance and social value. Every loan, deposit and investment is assessed not just for returns, but for the positive change it creates. We exist to be the bank with a social conscience, supporting organisations that deliver community, economic, social and environmental benefit across the UK.

Each year, we produce an Impact Report that brings together the outcomes we’ve helped create, alongside our customers, over the past 12 months. The report is how we hold ourselves accountable, showing clearly how your money helps to support people, build stronger communities, and protect the planet.

Our Impact Resources

What we delivered in 2024

In 2024, our lending helped protect or create over 3,000 jobs, support 1,800+ care beds, 1,800+ nursery places, and 1,100+ affordable homes, driving progress where it’s needed most.

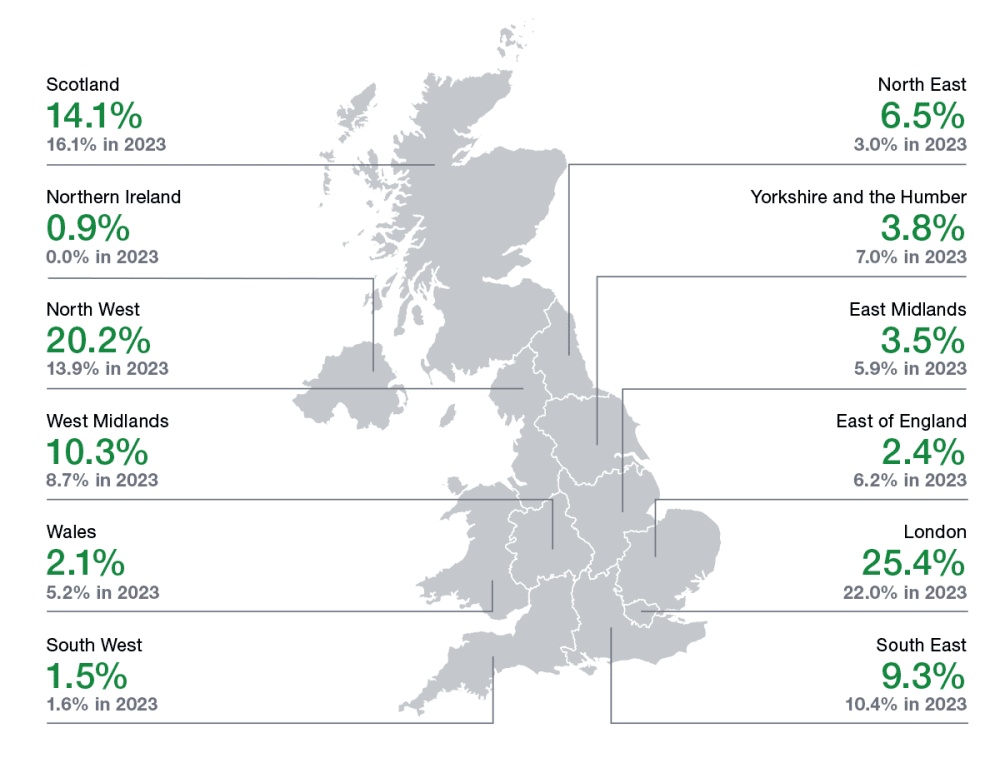

Our impact across the UK

From Scotland to the South West, our lending fuels growth and regeneration in areas of high deprivation, helping local economies build confidence and opportunity.

Regional distribution of new commitments in 2024

We continued to provide loans across the UK in 2024, with 50% (2023: 46%) of our loans going to organisations based in areas of high deprivation.

We increased our loan allocation in areas such as North West 20% (2023: 14%), North East 6% (2023: 3%) and West Midlands 10% (2023: 9%). London continued to be the largest regional concentration with 26% (2023: 22%).

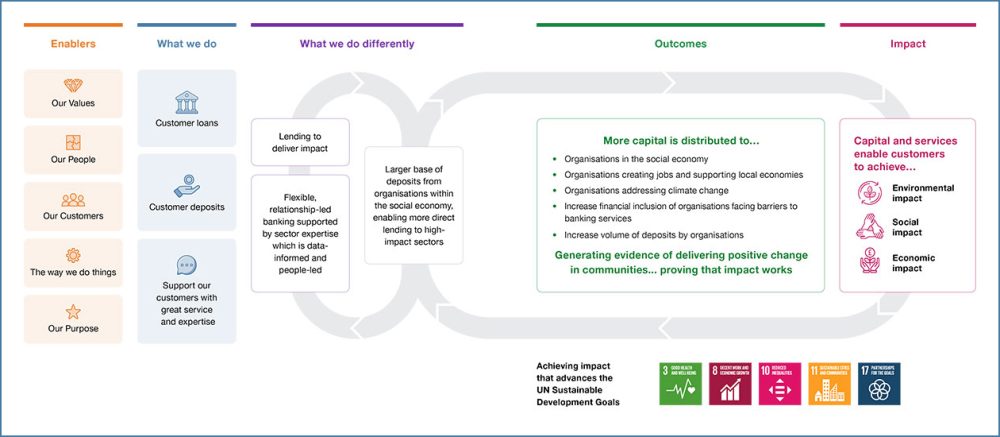

Our impact model

This impact model shows how Unity’s actions contribute to and deliver a range of positive social, economic and environmental impacts in the UK all aligned to our purpose:

Build your own impact model

See how our approach connects purpose to outcomes, and how your organisation can apply the same principles to measure and manage its own impact.

United Nations Sustainable Development Goals (UN SDGs)

We measure against the UN SDGs to ensure every pound we lend helps deliver meaningful impact across the UK. We focus on sectors and organisations that deliver tangible community benefit. Every lending application undergoes a values-based assessment to ensure the organisation:

- Makes a positive social or environmental contribution.

- Operates ethically and responsibly.

- Supports stronger, fairer more inclusive communities.

- Demonstrates long-term sustainability and financial resilience.

If an organisation’s activities conflict with our mission, we don’t finance them.

When your money is used to back organisations that support the UN SDGs, it helps build stronger communities, a healthier society and a more sustainable future. That’s why we choose to lend with purpose, and why who you bank with truly matters.

Choose a bank that shares your values

For over 40 years, we’ve delivered strong returns while funding sectors that make a real difference, from housing and healthcare to education and community growth. Our current accounts, savings accounts and responsible lending enable organisations like yours to make a lasting difference in their local communities.