Unity is now investment grade credit rated

Unity Trust Bank is now investment grade credit rated

This landmark achievement strengthens Unity’s position as a leading social impact bank, demonstrating Unity to be a good choice for customers looking for their money to make a difference and be placed with an investment grade institution.

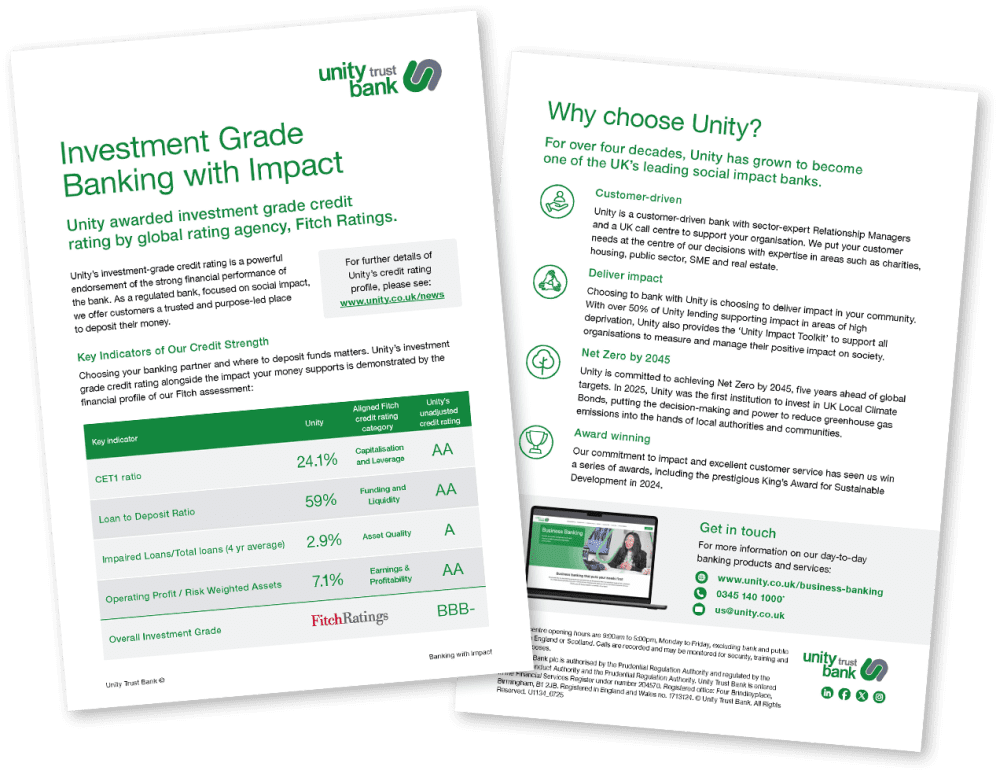

Fitch Ratings, a leading global provider of credit ratings, market commentary and research for global capital markets, has awarded Unity the investment grade rating of ‘BBB-’.

The rating is an endorsement of the bank’s disciplined growth, robust governance and sustainable financial performance.

Download our new brochure showcasing all the customer benefits of banking with Unity Trust Bank as an investment grade rated bank.

What is a Fitch Rating?

Fitch Ratings is a leading provider of credit ratings, commentary and research on global financial institutions, companies and governments. Their in-depth research and analysis provide insights into financial markets, economic trends and creditworthiness.

| Category | Unadjusted Rating | Adjusted Final Rating |

| Operating Environment | AA | Overall investment grade BBB- credit rating, with Unity strengthening its position as a leading social impact bank. |

| Earnings & Profitability | AA | |

| Capitalisation & Leverage | AA | |

| Funding & Liquidity | AA | |

| Asset Quality | A | |

| Business Profile | BB | |

| Risk Profile | BBB- |

Credit Rating overall: BBB-

To view the full Fitch Ratings announcement, click here >

Customer Impact

Unity’s ‘Investment Grade’ credit rating is a powerful endorsement of its financial strength and mission. It signals to customers and the market that Unity is a purpose driven bank designed to grow your money responsibly, with transparent impact for people and the planet.

Vision for the future of social impact banking

As Unity continues its journey to become the social impact bank of choice for organisations across the UK, this newly achieved credit rating offers a tremendous opportunity.

This accreditation will provide increased reassurance for organisations and enable those who want to deposit their money with us to see it being put to good use, to do just that. This ambitious plan for growth aligned to our double bottom line will allow us to make outsized impact in decarbonising hard to reach sectors whilst catalysing inclusive growth across the UK.

If you stand for something, your money should too.

To find out more about our recently published Fitch credit rating, as well as how Unity is helping to deliver positive social impact across communities in the UK, click here >